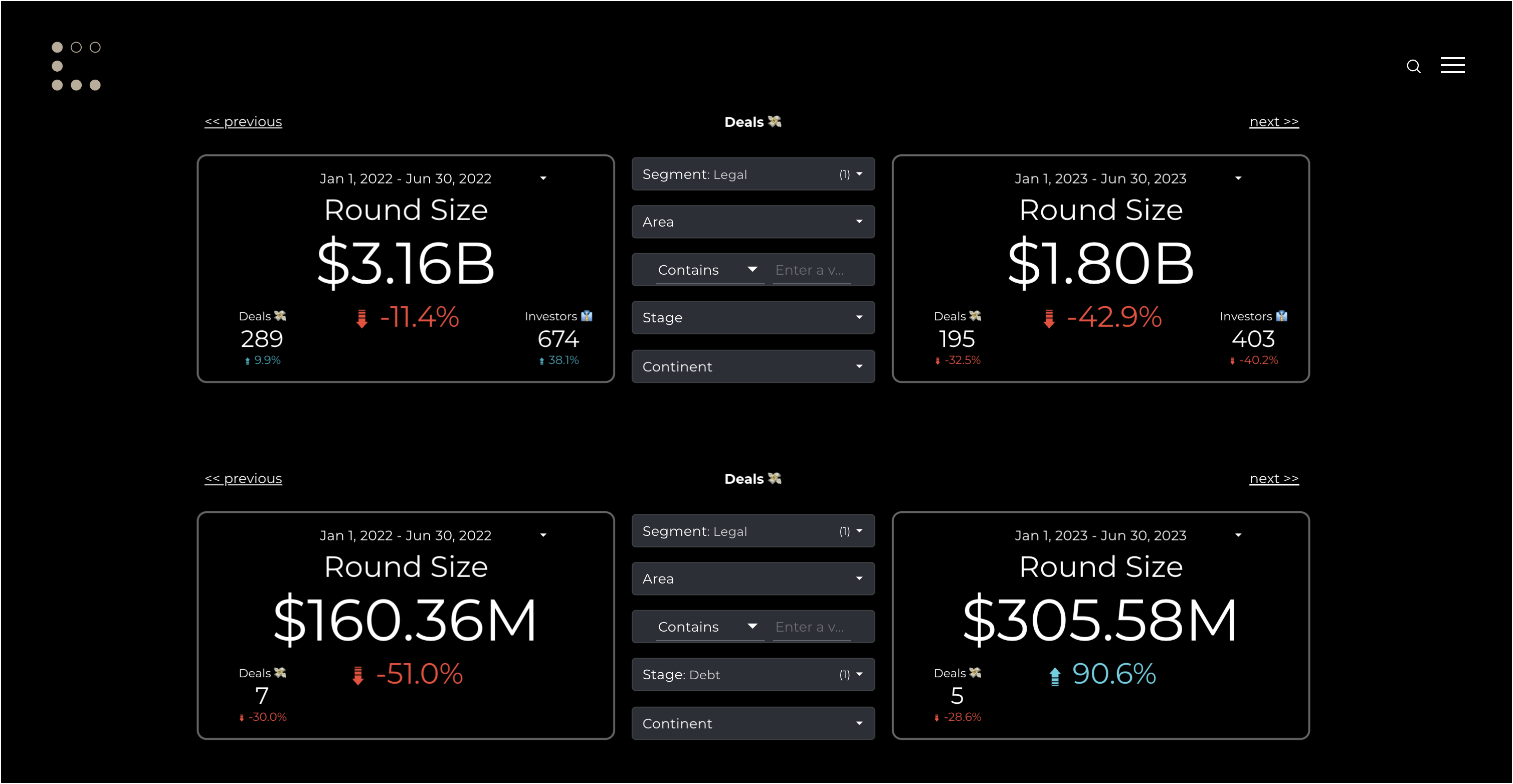

Investment in legal and tax technology companies dropped by 43% in the first half of 2023, down from an H1 2022 figure of $3.16bn to $1.80bn, we can reveal. Debt financing deals across the first six months of the year nearly doubled in the face of lack of equity options, data from analytics company Legalcomplex.com shows. And to add more doom and gloom, the figures from June are worse.

Data from Legalcomplex.com shared with Legal IT Insider shows that debt financing deals rose from $160m in H1 2022 to $305m in the same period this year. Legalcomplex co-founder and CEO Raymond Blyd struck a note of optimism, telling Legal IT Insider: “By switching from VC & PE money to debt there is no loss of equity, shares, ownership and control, and it presents simpler exit conditions” adding, “Only ‘healthy’ companies are able to raise debt, such as companies with assets or a strong balance sheet.”

However, the figures are indicative of fairly brutal global economic conditions, including high inflation and rising interest rates, which have led to a wider drop in global technology investment. UK tech investment fell by 57% in the first half of the year, while that figure was 55% in France and 44% in Germany, according to data out in June from investment firm Atomico.

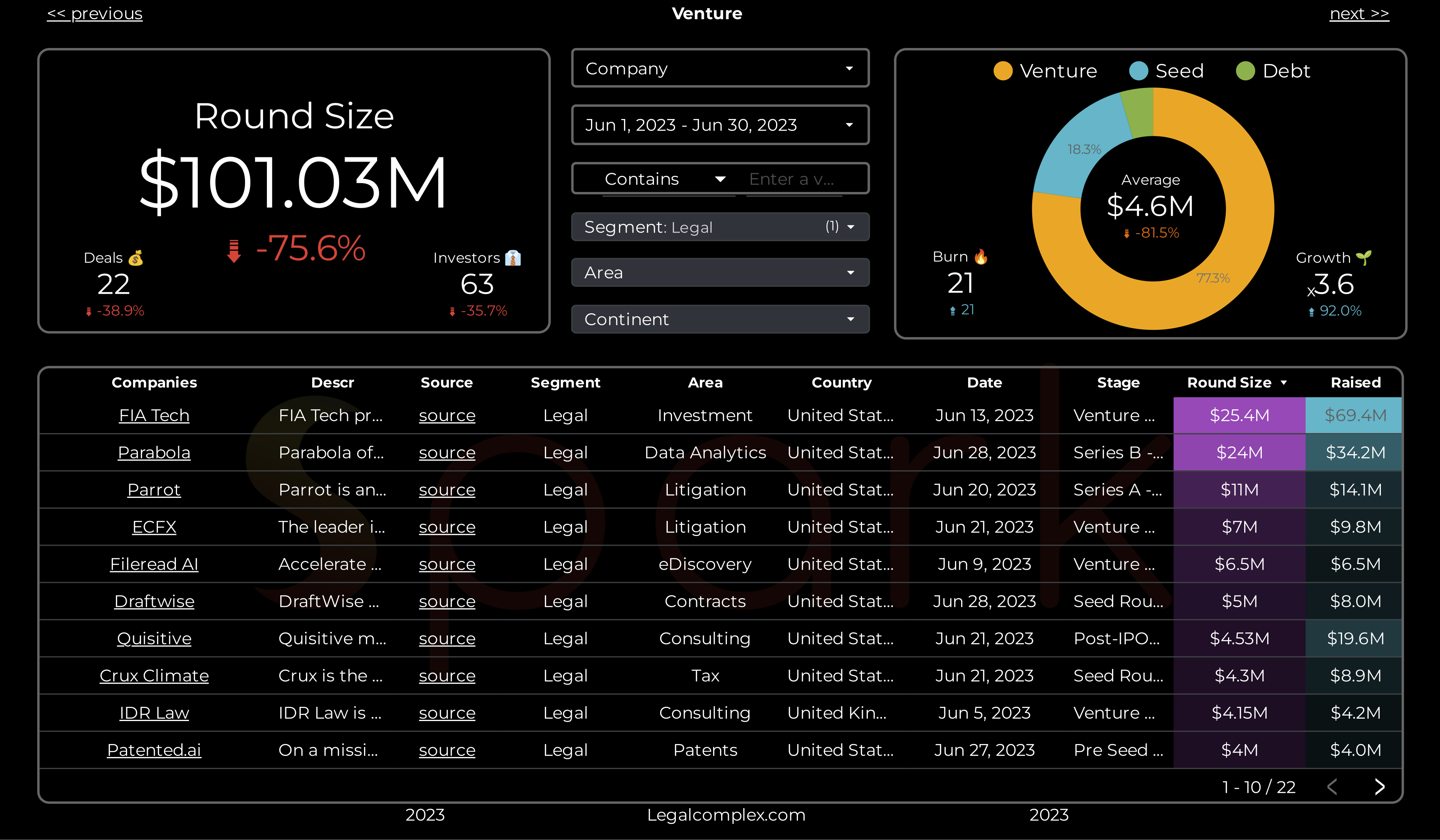

If the Legalcomplex figures from the past month are anything to go by, the stats will get worse before they get better – with a possible caveat. In June, investment dropped by almost 76% to $101.03m. There were 22 deals – a 38% decrease on June 2022 – and 63 investors, which is a 35% decrease on that period. The average round size dropped 81% from $11.5M to just $4.6M. Later-stage fundraising was 77% of the total, whereas last year it was almost 93% of all fundraising.

Blyd said: “Throughout the quarter, it has been observed that mature companies are facing difficulties in raising funds and are increasingly turning to debt financing to keep operations running. Conversely, early-stage (or seed) companies are seeing a comparative increase in funding.”

The caveat is around the vast interest in generative AI companies and Blyd added: “GPT will influence the second half of this year.”

You can find more Legalcomplex data here: https://www.legalcomplex.com/