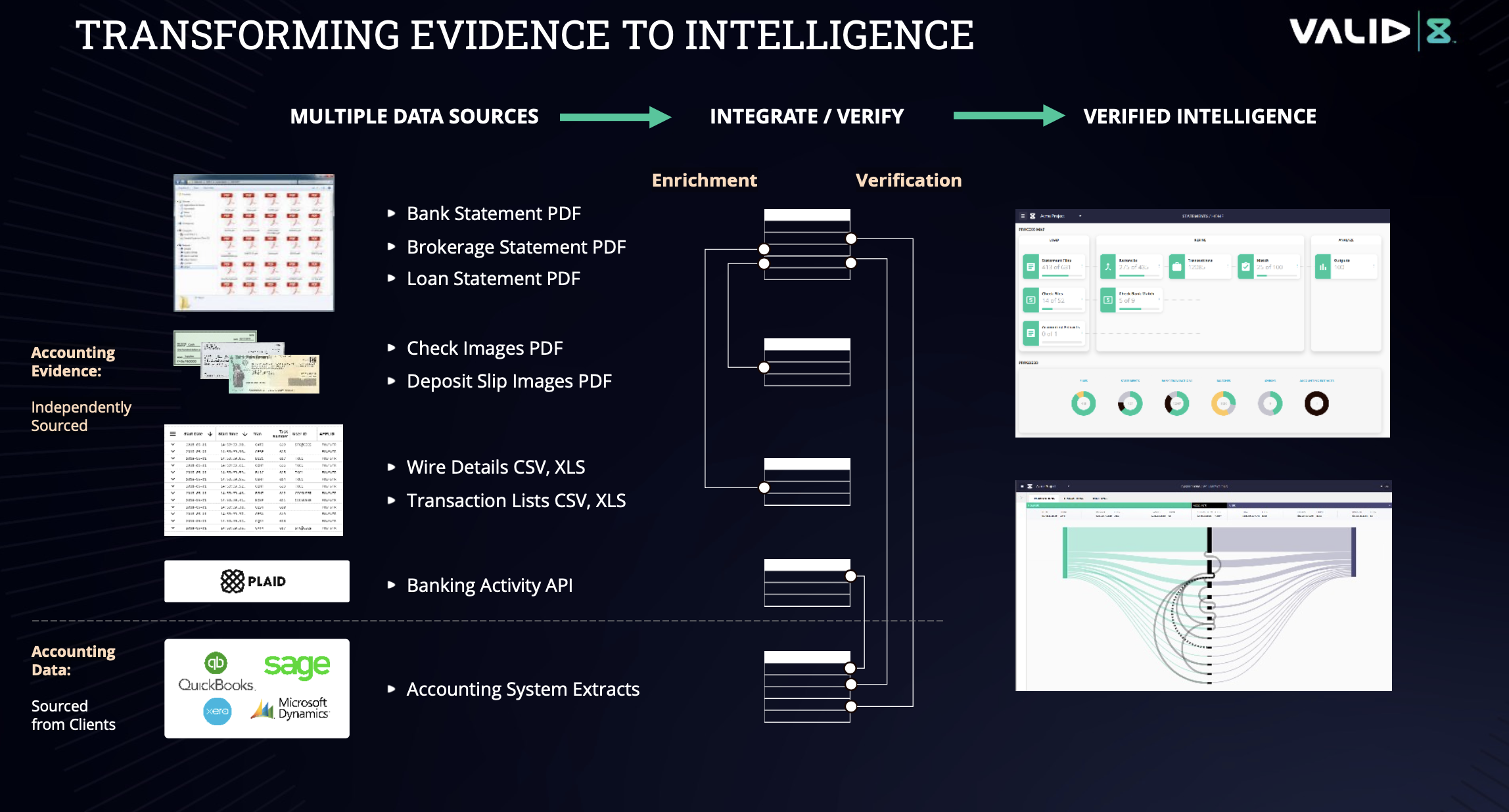

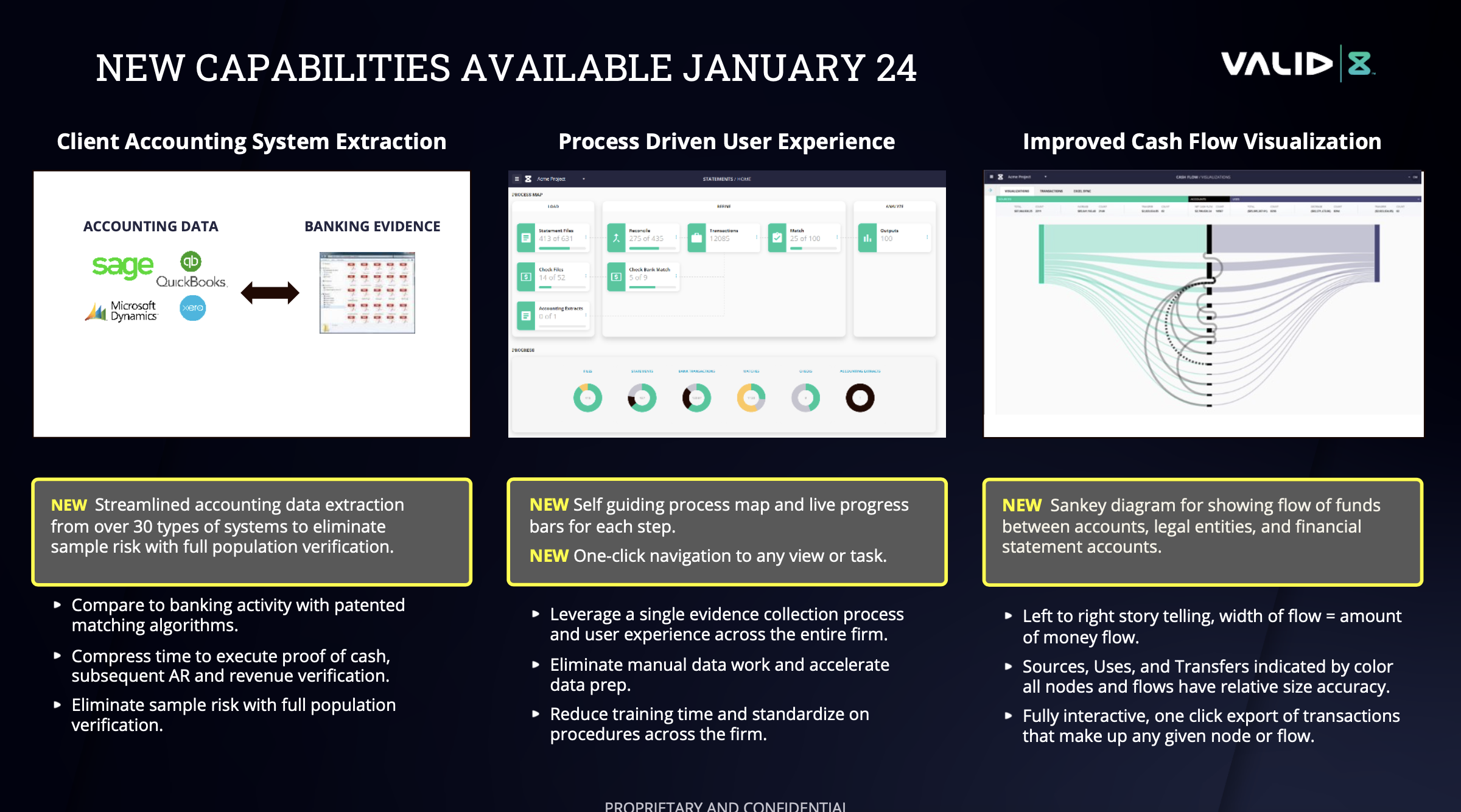

Seattle-headquartered forensic accounting software provider Valid8 Financial today (24 January) announces the launch of major new functionality within its financial investigation and audit platform, which can now extract and aggregate data directly from over 30 client accounting systems and independently sourced accounting evidence.

Verified Financial Intelligence (VFI) is a SOC2-certified, professional-grade verification solution that allows CPAs and attorneys to follow the flow of money. Once Valid8 extracts and processes the data, it uses labelling tools to group and filter accounts and transactions. This information is then populated into interactive charts, with new Sankey diagrams able to show the flow of funds between accounts.

Valid8 was founded in 2017 by Chris McCall and Tod McDonald, who in his time as a senior auditor at EY before the turn of the century, worked on large Chapter 11 bankruptcy cases, including one particularly high-profile case where the company had falsified their assets. Speaking to Legal IT Insider ahead of this new announcement, McCall said: “In the past you had to go back to the evidence and the banking data and spend years and millions of dollars assembling the evidence. That was the genesis of Valid8.”

The company has been developing its product over five years and with this release, McCall says: “We have improved the user experience and introduced visualisation to show the profession the flow of money, to make it much easier and quicker to render an opinion.”

Currently data collection, clean up and preparation is a highly laborious and lengthy process, meaning that often opinions are rendered on a small sample of the data available. McCall said: “What we believe should happen, and can happen using our system, is that you extract data from multiple sources, leveraging our fintech APIs. Once you have all the evidence, we help you visualise it and put it into pictures that make it easy to follow the entire revenue cycle.”

He adds: “If there are discrepancies, we can tell you what revenue is not in the bank account, so you know what you need to look at more closely.”

Valid8, which has around 150 law firm clients across the UK, US and Canada, is used in high profile fraud and white-collar crime cases, as well as high net worth divorces cases and government investigations. It was used in the lawsuit against celebrity attorney Michael Avenatti, who was last year sentenced to 14 years in prison for embezzling his clients’ money.

The software can also be used in an M&A process for due diligence, enabling deal teams to more quickly compare accounting data to banking activity, eliminating sample risk.

“In the last ten years, there’s been an explosion of fintech investment into new solutions that simplify access to accounting evidence and financial data, but they lack the integration between different sources, limiting their usefulness for CPAs and attorneys,” said McCall. “Our approach addresses this data gap, helping customers measure risk in financial statements, allowing them to narrow their focus to the most critical areas – drastically increasing the speed to opinion.”